Can Your Charter School Bonds Catch the Flu?

With school districts cancelling classes around the country, the concern is that charter schools will take the same step. What effect will such an action have on investors in high-yield tax-exempt charter school bonds? There are a few factors to consider.

What the State Requires. Each state has requirements for the minimum number of days of instruction to be delivered by its traditional public and charter schools. That said, they are often silent on how the days of instruction must be delivered. For charter schools that have the ability to execute a distance learning strategy with students learning in the safety of their own homes, the sate requirement should be met – regardless of class cancellations.

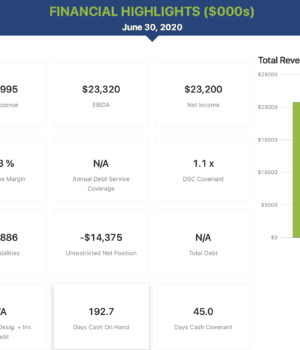

What About Payments for Enrolled Students? Charter schools receive per pupil payments based on the enrollment at certain points during the year. In California and North Carolina, for example, the enrollment is measured twice yearly. As long as the enrollment count is correct, it is unlikely a charter school will not receive its per pupil payments due to class cancellations since the students are still enrolled. It would be a particularly difficult step to take if the neighboring district school had class cancellations as well.

Unbudgeted Costs. There may be unbudgeted costs incurred by class cancellation, such as the cost of ramping up distance learning. Does each student have a laptop and internet service at home? Do teachers have the capability to deliver their lessons remotely? What if the school year has to be extended to make up cancelled days? What operating costs are connected with the longer school year?

As long as these three factors are kept in mind, charter school investors should suffer nothing more than a mere headache.