Stuff Happens: Informing the Muni Market Upon an Emergency Event at Your Charter School

“That’ll never happen!” While we all may have said that at one point in our lives, we are probably saying it less in the past two years. Large-scale tropical storms, disease outbreaks, fires and significant weather damage are among the emergency events that can have a material adverse impact on the finances and operations of a charter school borrower. Without information related to such emergency events and their impact, charter school bond investors have no way to accurately gauge the creditworthiness and value of a charter school bond. What is a charter school borrower to do to keep municipal bond investors informed? What many borrowers did—or more precisely, didn’t—disclose for COVID-19 (or other emergency events) may not cut it anymore going forward.

When COVID-19 hit nationally in March 2020, most charter school borrowers closed their buildings, made sure students, faculty and administrators were safe and pivoted to distance learning. With no information related to COVID’s impact from charter school borrowers at that time, the market value of charter school bonds plummeted with that of most all municipal bonds. While all investment banks are required to have a mechanism in place for charter school borrowers and municipal bond issuers to comply with SEC Rule 15c2-12 and disclose “material events” when they occur, those events are limited to 16 events – none of which capture COVID or other emergency events and their impact.

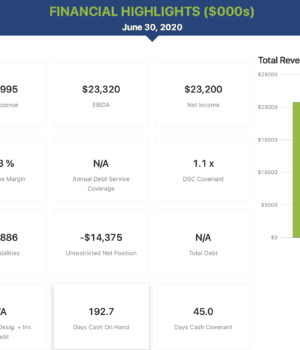

As a result, most charter school borrowers made no filing when COVID hit, leaving a dearth of information for the charter school bond market. In contrast, in April 2020, many charter school borrowers with School Improvement Partnership as their Continuing Disclosure Agent filed a voluntary continuing disclosure filing on EMMA addressing questions like the percentage of students with laptops for distance learning and the percentage with internet access. For those charter school borrowers, a second voluntary continuing disclosure filing was made in July 2020, disclosing unbudgeted costs as a result of COVID and any governmental grants or loans that had been accessed.

What steps should be taken to guard against an undue decline in the market value of charter school bonds when the next emergency event occurs? The first step is for the investment banks and the charter school borrowers to define what an “emergency event” is under the Continuing Disclosure Agreement governing their bond financing. According to the National Federation of Municipal Analysts, it is “an emergency situation that will have a material impact on [the charter school’s] fiscal health and/or operational sustainability.” COVID certainly qualifies, as would large-scale tropical storms, other disease outbreaks, fires and significant weather damage.

A second question emerges regarding a voluntary filing for an emergency event: what types of information should be disclosed? The NFMA gives seven examples: (1) Amended Budgets as a Result of the Emergency Event; (2) Material Declines in Enrollment; (3) Deterioration in Revenue; (4) Cost-Cutting and Austerity Measures (Employee Layoffs, Employee Furloughs, etc.); (5) Federal and State Grants and Loans; (6) Draws Upon Alternative Liquidity Sources/Addition of Supplemental Liquidity Sources; and (7) Material Delays in Financed Construction Projects.

The final step: make sure the bond financing has in place a dissemination agent or continuing disclosure agent that does not simply file a pre-printed form on EMMA with boxes checked, but instead has the capability to provide the requisite information to the market on a timely basis. As the NFMA White Paper states, “The National Federation of Municipal Analysts (NFMA) believes that access to current, complete and reliable information on material risks and events affecting a municipal issuer’s ability to repay publicly issued debt is critical to municipal bond investors’ ability to make informed investment decisions.” With a disclosure partner like School Improvement Partnership, charter school borrowers and municipal bond investors are better protected when emergency events occur.