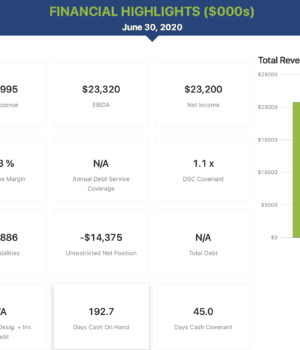

Per Pupil Payments for Urban Charter Schools Remain Stable

With COVID19 and the related economic fallout causing dramatic loss of revenue for state and local governments, investors in charter school bonds worry that school funding will be cut as governments struggle to balance their budgets. Announcements from several large jurisdictions indicate that hasn’t happened, at least not for fiscal 2021. For New York City, the FY 2021 levels ($16,123) are flat when compared with FY 2020 ($16,150). For Philadelphia charter schools, there is a 7% increase in Basic Education payments and a 5.3% increase for Special Education payments. Chicago charter schools are expecting per pupil payments to be flat year-to-year, as are North Carolina charter schools.

While there is stability in terms of revenues projected for FY 2021 for charter school borrowers, expenses are more difficult to project. Does the budget contemplate on-site instruction, distance learning or some of both? The good news is that, having been through three months of distance learning since the March shutdown, the learning curve and cost of this capability was covered in FY 2020. As more states open their schools, the financial risk of owning high yield charter school bonds will continue to shrink.